Every two weeks, I share my thoughts about investing, career transitions, meaningful work, parenting, living intentionally, and other topics that engage me. I'm in my fifties and still trying to figure stuff out.

Beyond the Cove - Field Notes, Outlasting Cycles, and Give Now

|

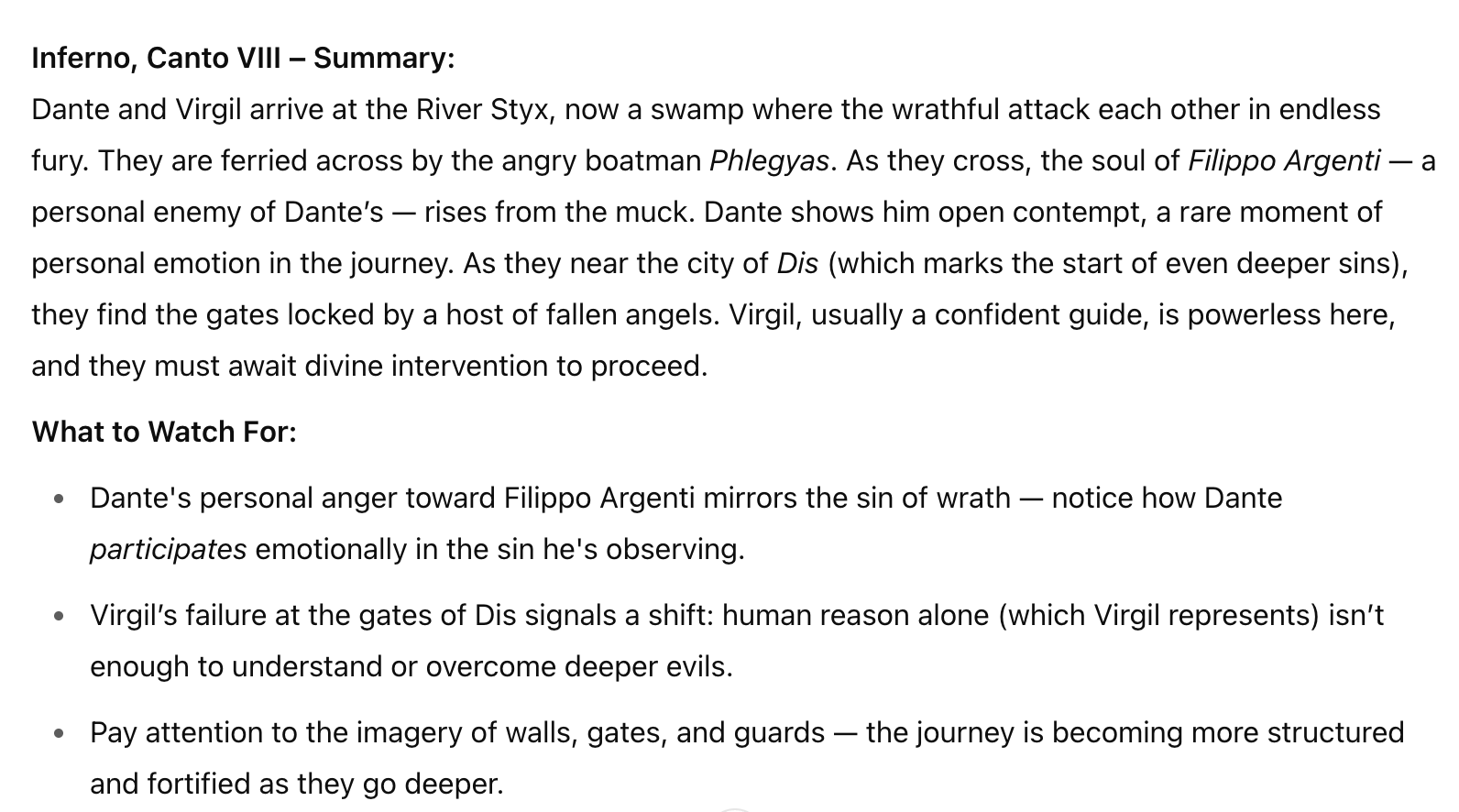

Welcome. 👋 Every two weeks, I share my writing on investing, career transitions, meaningful work, parenting, living intentionally, and other topics that engage me. I'm still trying to figure stuff out. Was this newsletter forwarded to you? See past articles and subscribe here. Field NotesWhen I launched Beyond the Cove, it was really just a way to sharpen ideas by putting them into words and then out into the world. Writing helps me reflect on stuff and figure out what I actually believe. What I didn’t expect was how much I would enjoy the conversations that followed. That’s been a bonus and something I sincerely value, especially as I further disengage from social media. Thank you for reading, replying, texting, and reaching out. It has made this feel a lot less like talking into a vacuum. This month marks three years of consistent writing. Back in May 2022, I restarted the newsletter after what I thought would be a short break, maybe 1-2 months. That break turned into nine months. I don’t want to make that mistake again. With my predecessor now retired, my daughter graduating from high school, and some other personal and professional projects keeping me busy, the next few months will be packed. I know, we’re all busy. I usually spin plates relatively well, but I might be hitting my limit. So, rather than step away from this regular dialogue, I’m going to experiment a little. I’ll try some shorter formats that are quicker to write and, hopefully, just as interesting for you to read. Today, I am starting with the first experiment, Field Notes. I’ll just mention a few small things I noticed lately that made me think, smile, or look twice. Maybe they’ll do the same for you. Thanks again for being part of this experience. Let’s see where this takes us. As always, I welcome any feedback or ideas. Just hit reply.

Thanks for reading. Hope a few of these sparked something for you, too. See you next time. Other StuffAlpha Isn't Timing the Cycle. It's Outlasting it. This interview with Greg Bates, President and CEO of GID Investment Advisors, a $35B AUM diversified real estate developer/investor/operator, is a must listen for any real estate investor. Not only does Greg share valuable insights into current market trends and a compelling case to buy quality multifamily and industrial assets today, but Greg also offers honest reflections on his career path and his authentic leadership style. Admittedly, I'm biased. For years, Greg has been a friend and extraordinary mentor in my real estate journey. Watch the interview (59 minutes) The Great European Rotation This short piece from Verdad Capital highlights the case for European stocks, particularly European microcaps. The case for some international exposure feels more compelling than it has in years, especially after the recent snap-back in the US. Europe (and EM and much of Asia) have had lower valuation multiples for years and perhaps for good reason. But now, in addition to the valuation case, you have favorable capital flows, fiscal stimulus in many markets, and a credible case for dollar weakness. I would think more US investors might question whether zero international exposure is appropriate in this context. And, if more international is the right answer, they should carefully evaluate whether cap-weighted or hedged ETFs offer the exposure they want. As ever, this is not investment advice, but prudent encouragement to ask questions. Read the essay (4 mins) Give Now, Not Later I've been fascinated with the non-traditional idea of transferring at least some of your wealth while you're still around since I read Die with Zero by Bill Perkins. In this short essay, Nick Maggiuli riffs on the idea of helping your beneficiaries when they need it most, typically when they're in their 20s or 30s. Maggiuli references research from UPENN that shows, "the age range at which someone is most likely to receive an inheritance is 56-65." This age is increasing as we live longer. Perkins' ideas have deeply influenced my thoughts on estate planning and personal finance. This particular strategy resonates, and it's one I plan to act upon. "When you ask people whether they would prefer $250,000 at age 30, $500,000 at age 40, or $1 million at age 50, people overwhelmingly wanted the lower amount earlier in life. 70% of respondents who answered this question chose $250k at age 30." Read the article (6 mins) And a Farewell Photo... |

Hi! I'm David.

Every two weeks, I share my thoughts about investing, career transitions, meaningful work, parenting, living intentionally, and other topics that engage me. I'm in my fifties and still trying to figure stuff out.